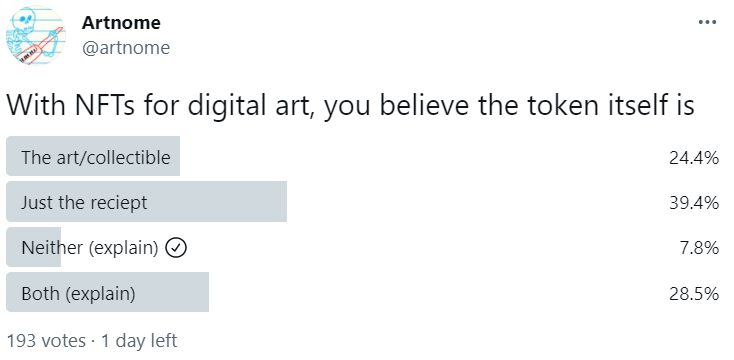

NFT = Autographed Crypto Token

I spent one full day pondering before concluding the best answer is “Neither”. An NFT is essentially an autograph. An Art NFT has the artist’s artwork linked to the token to magnify the value proposition of the autograph. Autograph is more than an analogy to the handwritten original. Crypto in its core is made up of signatures. Every time you spend Bitcoin, Ether, or any other crypto token, you sign […]