I did a little bit of research on inflation. Here are my notes.

What triggers hyperinflation, quote Wikipedia:

- Hyperinflation is often associated with some stress to the government budget, such as wars or their aftermath, sociopolitical upheavals, a collapse in aggregate supply or one in export prices, or other crises that make it difficult for the government to collect tax revenue.

May the pandemic, with its frequent lockdowns and exuberant stimulus packages, also be an inflation trigger?

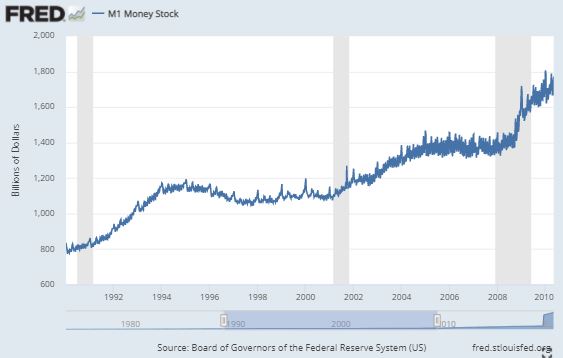

Let’s look at the M1 money supply. This is basic money such as coins, bank notes, demand deposits and traveler’s checks.

The historic context is important. A decade ago too-big-to-fail banks were bailed out. It was highly controversial at the time. The M1 money supply increased from 1400 billion to 1600 billion – a staggering two trillion dollars:

That’s bad enough but let’s extend the graph to the current day (May 2021):

2020: From 4 trillion to near 20 trillion! The graph speaks for itself!

A lot of money has poured into financial assets.

- Gold is up 9.6% y/y (today is 30 May 2021)

- S&P 500 is up 38%

- Bitcoin is up 280%

But also consumer goods are getting more expensive.

I am not a fan of the official numbers. I think they tend to underestimate inflation, but even these stats are spiking up. In a few months the official inflation may reach 25 year highs which should raise alarms even with Washington bureaucrats.

Owners of US Debt

This article gives an oversight over who owns the US national debt.

- The debt is $28.1 trillion (March 2021)

- The FED has extended QE to an unlimited amount

- It now holds $7.8 trillion

- 22% is held by foreign governments

- #1 is Japan with $1.3 trillion

- #2 is China with $1.1 trillion

- Russia is off the list

I find three things particularly worrying:

- The Federal Reserve is buying trillions worth of securities. Explained by Peterson Institute.

- The Federal Reserve’s purchase of longer-term Treasury securities is part of their efforts to support the economy through quantitative easing. Those purchases inject money into the economy to lower interest rates and therefore encourage lending and investment. Such efforts by the Federal Reserve help mitigate the economic fallout from the pandemic along with spending on safety net programs such as unemployment compensation and other programs created to provide aid to sectors of the economy hit hardest by the pandemic.

2. China owns $1.1 trillion worth of US treasuries. It gives them lots of leverage. Who will buy if China decides to sell?

3. Russia already did sell. In 2018 they reduced their holdings from $100 billion to $15 billion. This caused a short term increase in interest rates. If China does the same, will the market be able to absorb it?

What’s clear is that the government is addicted to low interest rates. It’s not much different from an alcoholic being addicted to alcohol. To keep interests low someone needs to buy bonds, and I’m not so sure infinite QE is very sustainable.

Interest on the National Debt

A quick google search states that 7.8% of the federal budget is interest on the national debt. This is with a 2.2% interest rate.

Btw, $4 trillion is spent (or to be spent) on covid relief.

Final Notes

I like to look at hard numbers to make up an opinion. What I have here are a few pieces in a very complex puzzle.

But as far as I can see, inflation must be picking up. In the best case we’re facing <10% inflation per year over a few years until everything stabilizes. But I’m afraid this is wishful thinking. Who are to buy treasuries at 2% interest when the currency loses value at much higher rate? Sure, pension funds will keep on buying for bureaucratic reasons and friendly nations will continue because politics. Even then, there are limits.

An outright collapse is also possible. The bond market is a market after all. If not for QE the bond market bubble would likely have burst already.

Even with QE, I don’t think the exponential nature of debt money can last forever. If or when the bubble bursts, interests will go from near zero to double digits in no time.

Remember the last crisis. Governments took up debt to save the banks. If they had not, the entire banking system would have collapsed (or so they said). They kicked the can down the road, and by now the problem has grown to the government level. The only way out then is by debasing the currency.

It’s not such a far fetched idea either. Here’s a list of 29 hyperinflations over the past 100 years. What makes this time different is that virtually all economies are in the same boat. The bond market is a web connecting all governments, currencies and most companies.

Categories: Uncategorized

Tags: economics