The electric vehicle producer Daymak Avvenire promises bitcoin mining in their upcoming Spiritus Deluxe model. Delivery is estimated for 2023 but you can pre-order it already now. Their campaign states:

- The Daymak Spiritus will be the first electric car in history to mine cryptocurrency while it is parked, including Bitcoin, Doge, Ethereum, Cardano, and more.

This makes no sense!

- Cardano is not mineable. It uses proof of stake. You need to own Cardano to stake Cardano.

- Ethereum is switching to proof of stake. By the vehicle’s 2023 delivery Ethereum will not be mineable either.

- Bitcoin and Dogecoin use different mining algorithms. Theoretically the car could carry two mining rigs – one for double SHA and one for SCRYPT, but this would add cost, weight and take up extra space.

- Mining generates heat. Lots of heat! In fact, all the electricity that goes into mining converts to heat. As you know, parked cars get hot in the sun. Add mining to this, and you need very big fans to cool down your car.

If you’re still excited about mining from your car, let’s have a look at the profitability.

An Antminer S9 can be purchased used from $750. Its hashing rate is 14.0TH/s at an efficiency of 0.098W/GH. The total power consumption is 1372W.

A home 220V charging station typically delivers 7200W. You could potentially fit five miners.

A miner is about the size of a shoe box. How much trunk space would be left after five of these? And don’t forget, this is for Bitcoin miners only. Doge needs separate miners. The Spiritius is not exactly the most spacious car either:

Those five Antminers sum up to $3750. Perhaps Dogecoin miners are cheaper, say $5000 total. This would be 25% of the car’s $19.999 price tag.

Okay, it’s obvious they cannot fit an array of miners in the car. Maybe I missed the point in the first place?

What if they only put one miner in the car? Let’s give them some slack and forget Dogecoin. One BTC Antminer is enough. But even then, does this $750 piece of hardware make economic sense?

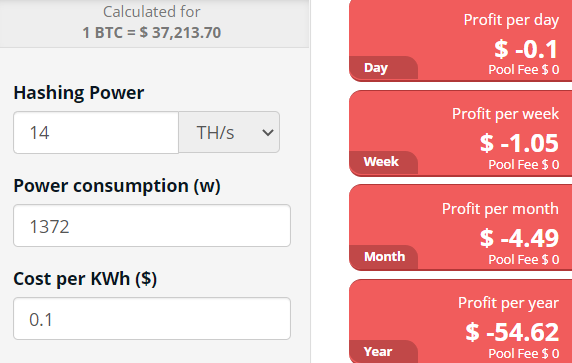

I open a mining calculator, assume an electricity cost of $0.10 per kWh, and get this result:

The result is clear. Not only did the miner cost $750 in the first place, every time you turn it on you lose money. The Bitcoin it generates is worth less than the electricity it consumes.

Of course, as the Bitcoin prices fluctuates and the mining difficulty adjusts, you may get into green. But I doubt it. As more people mine and more efficient chips reach the market, profitability drops.

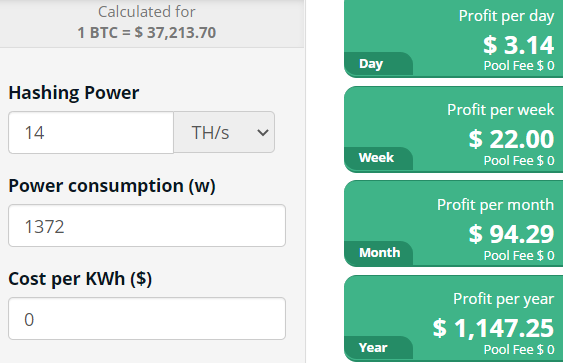

What if you have free electricity? For example, your employer lets you charge at no cost.

Now we’re talking! Just keep in mind the car won’t be plugged in all the time. Eight hours plugged per day will drop the profit by 2/3. If you charge 200 days a year, your annual mining income is about $200.

So technically, with free electricity, you can expect to make back the $750 in four years.

But this is a horrible example. Siphoning off free electricity is super sketchy at best, illegal at worst. And one more point; cooling down your car/bitcoin mine will require some serious fans. We’re talking jet engine kind of noise here.

P.S. In case someone makes the argument; a regular CPU can mine too. Technically it can but over the course of a year a CPU will earn in the ballpark of $0.000002….

Categories: Uncategorized